3 Crypto Arbitrage Strategies For Traders

In investor parlance, arbitrage is the act of buying and selling an asset to take advantage of price differences.

Crypto investors can take advantage of arbitrage opportunities that were previously monopolized by institutional investors.

Why Cryptocurrency Is Changing the Arbitrage Game

Historically speaking, cryptocurrency arbitrage was reserved for banks, financial institutions, and the extremely wealthy.

Thanks to cryptocurrency, retail investors routinely use arbitrage to create profits out of thin air. Here are three arbitrage strategies that investors routinely use to boost their crypto profits.

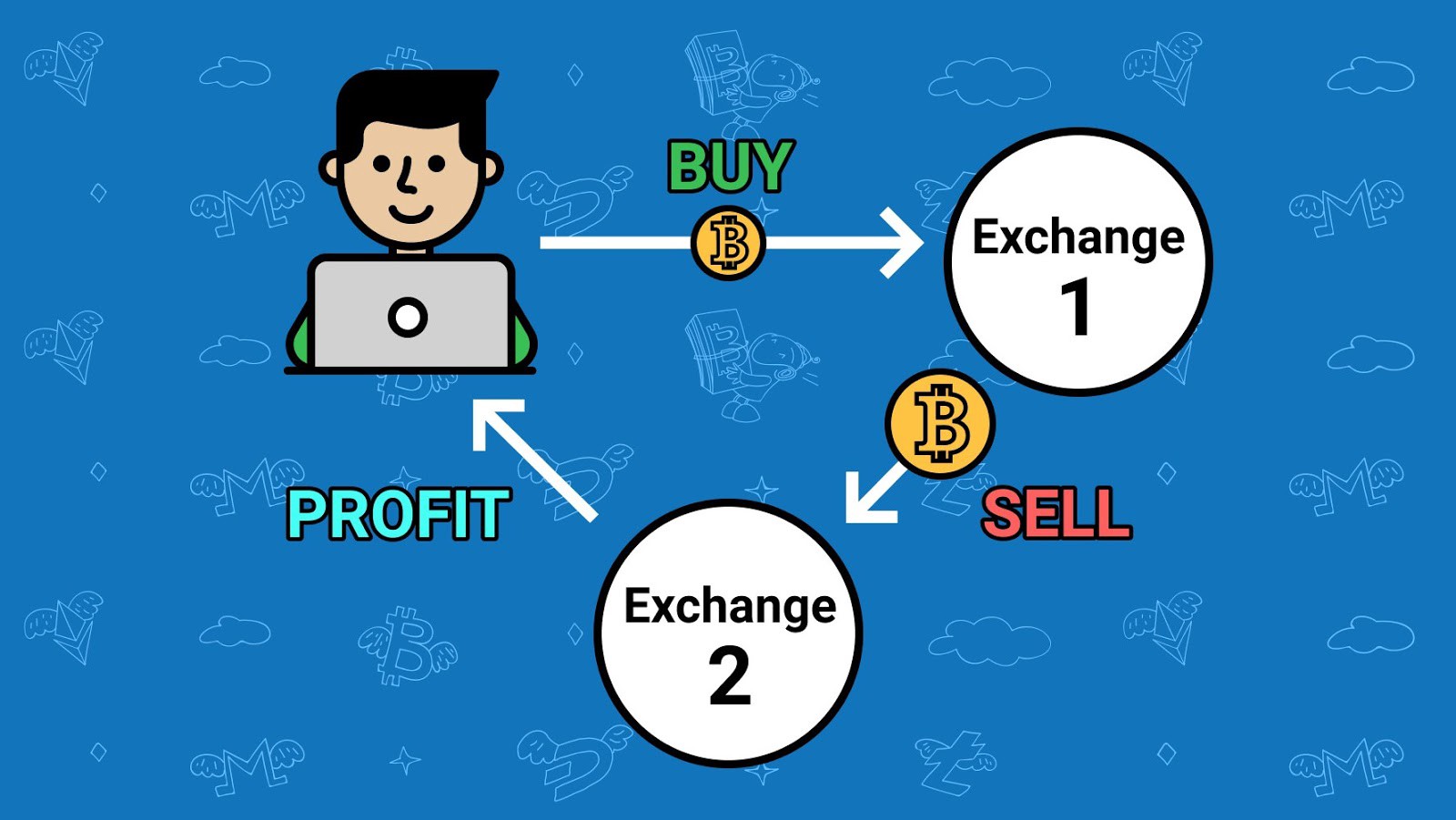

1. Simply Exploiting Price Differences Between Exchanges

You may already be using this tactic without knowing you are engaged in arbitrage. To do simple arbitrage, keep your eye out for price differences between crypto exchanges.

When you see a difference, buy the asset at the exchange with the lower price. Then withdraw the asset to an exchange where you can sell it at an increased price. This price difference represents pure profit for you.

Because of its simplicity, you can execute this type of arbitrage rapidly. This is ideal if you need to see immediate cash flow.

On the other hand, the amount of profit you will realize here is typically modest. Also, it is easy for other arbitrageurs to spot these price differences and take action. That means the window of time you have to act can be exceedingly short.

2. Introducing Triangular Arbitrage

This more complex trading strategy involves exploiting price inefficiencies across a set of three currencies. For example, you could buy one BTC for $50,000.

Then you could trade your BTC for 15 ETH. If you can sell your ETH for more than $50,000, you’ll see a profit. Requiring three coordinated trades, this type of arbitrage opportunity is rare and fleeting. If you act early and fast, however, triangular arbitrage can be incredibly lucrative.

3. Yield Arbitrage

Yield arbitrage is a slightly more sophisticated form of arbitrage strategy. This tactic involves finding interest rate inefficiencies. Yield arbitrage (YA) typically involves lending money to other traders.

Compared to the other strategies we’ve outlined, YA requires a relatively hefty initial sum to get started. Before getting involved in |YA, be sure to take all gas fees into account. As of late, these fees have proved especially high for ETH.

According to the finance experts at SoFI Invest, cryptocurrency “doesn’t have the same pricing conventions as equities and bonds.” This can allow hard-working investors to find arbitrage opportunities with relative ease.

No matter what, be sure to exercise plenty of caution when planning arbitrage moves. Keeping your leverage low is always a good idea in the world of investment. Though Bitcoin remains the most popular digital coin, there are plenty of other coins that are deeply promising for investors. In fact, more than 5,000 cryptocurrencies currently trade on more than 200 exchanges.

Arbitrage is one of many ways you can make massive profits through cryptocurrency. If you’re determined to succeed in cryptocurrency, you’ll want to keep an eye on promising new currencies that aren’t receiving adequate coverage in the popular news media.