The Essentials of Digital GST Invoices

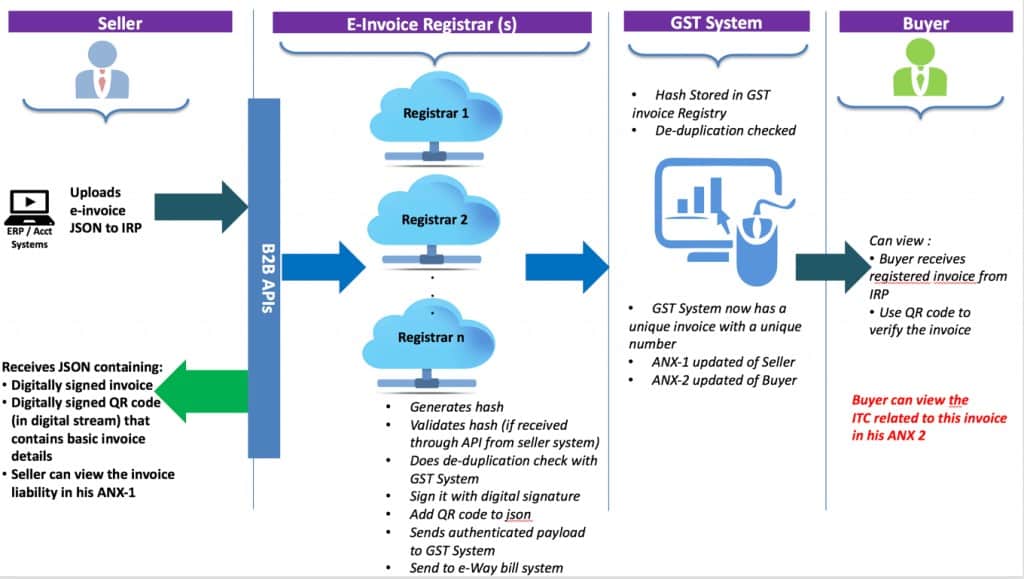

With the advent of E-invoicing, the search for an efficient GST processing system came to an end. It indicates that consumers can only generate e-invoices after obtaining an IRN (Invoice Reference Number). Then, they must fill out the FORM GST INV-01 and upload it to the recommended Invoice Registration Portals. These digital invoices would be generated through a single GST Government platform. One can also track application status (GST) on the same portal.

With the advent of E-invoicing, the search for an efficient GST processing system came to an end. It indicates that consumers can only generate e-invoices after obtaining an IRN (Invoice Reference Number). Then, they must fill out the FORM GST INV-01 and upload it to the recommended Invoice Registration Portals. These digital invoices would be generated through a single GST Government platform. One can also track application status (GST) on the same portal.

E-invoicing under the GST announcement will make it mandatory for firms to create an e-invoice for each and every sale made on the government’s GST portal from October 1, 2020. GST invoicing is required for certain groups of listed individuals (Businesses whose annual turnover is more than Rs. 500 crores in a financial year based on PAN). Due to e-invoicing, it is easier to track application status (GST).

Before or at the time of removing items for supply to the recipient, a registered person must provide a tax invoice. GST invoices for services can be issued before, during, or even after the time of supply. Furthermore, the e-Invoicing system is being phased in, requiring certain additional essential information.

Information Required in a GST Invoice

The contents of invoices are addressed in Rule 46 of the CGST Rules. The information under the following 16 headings must be clearly stated on the tax invoice issued:

- Name, GSTIN, and the address of the supplier

- Up to 16-character tax invoice number (It must be produced in a specific order, and each tax invoice will be assigned a unique number for that fiscal year.)

- Date of issue

- If the buyer (receiver) is a registered user, the recipient’s name, address, and GSTIN should be displayed.

- If the recipient is not registered and the transaction is worth more than Rs.50,000, the invoice should include the following information:

- Name and address of the recipient

- Address of delivery

- State name and state code

6. HSN code of service or goods accounting code for services

- Description of the services/goods

- Quantity of goods (number) and unit in UQC (kg, metre etc.)

- The total value of supply of services/goods

- The taxable value of supply after adjusting any discount

- The applicable rate of GST (Rates of SGST, UTGST, CGST, IGST, and Cess clearly mentioned)

- Amount of tax (With the breakup of amounts of SGST, UTGST, CGST, IGST, and Cess)

- For interstate sales, the location of supply and the name of the destination state are required.

- If it is different from the place of supply, then the delivery address.

- Whether or not GST is to be payable on a reverse charge basis

- The supplier’s or his authorised representative’s signature

Endorsement on Invoice under GST for exports

Certain invoices that are subject to GST must have an endorsement or mention on them. Exports of goods and services, as well as supplies to SEZ units or developers for allowed activities, are among the cases:

- Without tax payment under LUT or bond

- With tax payment

Depending on the criterion stated above, there are two sorts of endorsement text:

- On payment of an integrated tax, supplies intended for supplies/export to an SEZ developer or SEZ unit for authorised operations are permitted.

- Without payment of integrated tax, supplies designed for supplies/export to an SEZ developer or SEZ unit for allowed operations are made under bond or letter of commitment.

Conclusion:

Calculating GST on a given good or service can be both time-consuming and unpleasant. As a result, businesses are increasingly opting for GST billing software. They will save money, time, and effort as a result of this.

Business owners can use GST billing software solutions to conduct various tasks, including tax calculation, invoicing, billing, bookkeeping, and more.